US CFPB classification task

import pandas as pd

from sklearn.decomposition import LatentDirichletAllocation

from sklearn.feature_extraction.text import CountVectorizer, TfidfVectorizer

import pandas as pd

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import OneHotEncoder

from sklearn.metrics import classification_report, confusion_matrix

from sklearn.ensemble import RandomForestClassifier

import matplotlib.pyplot as plt

%matplotlib inline

import numpy as np

US Consumer FInancial Protection Bureau

As an intermediary, the CFPB receives a large number of complaints. To help the CFPB better manage them, they would like to reduce the complaints logged to those that are most likely to be successful. To help them to do this, they would like to be able to indicate to a consumer whether it is likely that their complaint will be accepted. This will help the consumer to decide whether they wish to go through the complaints process, and will reduce the number of complaints logged.

Therefore, your objective is to build a classification model that can be used to:

- Determine whether a consumer’s complaint will be accepted and whether they are likely to receive relief.

- Help the CFPB understand what factors affect how a company responds to the complaints that it receives.

This investigation is split into three sections:

Exploratory Data Analysis

Classification

Conclusion

On my github page, I have another notebook where I tried some neural net approaches. However, the performance wasn’t as good as Logistic Regression used here.

Exploratory Data Analysis

In this section, we perform some basic data cleaning, and plot the data to understand some of the features.

## if you haven't got the data, you can download it from here

## I've inluded a sample in this repo, just so you can see the code running

df = pd.read_csv('Consumer_complaints.csv')

df.columns = [c.replace(' ','_').lower().replace('-','').replace('?','') for c in df.columns]

df.columns

Index(['date_received', 'product', 'subproduct', 'issue', 'subissue',

'consumer_complaint_narrative', 'company_public_response', 'company',

'state', 'zip_code', 'tags', 'consumer_consent_provided',

'submitted_via', 'date_sent_to_company', 'company_response_to_consumer',

'timely_response', 'consumer_disputed', 'complaint_id'],

dtype='object')

def extract_year_month_date(datetime_series, dateformat=None, is_string=False):

## take a datetime series and return a dataframe containing the year, month,

## day and dayofweek

if dateformat is None:

infer_date_format = True

else:

infer_date_format = False

if is_string:

datetime_series = pd.to_datetime(datetime_series, infer_datetime_format=infer_date_format, format=dateformat)

# print(datetime_series)

colname = datetime_series.name

year = datetime_series.apply(lambda x: x.year).to_frame().\

rename(columns = {colname:'year_{}'.format(colname)})

month = datetime_series.apply(lambda x: x.month).to_frame().\

rename(columns = {colname:'month_{}'.format(colname)})

day = datetime_series.apply(lambda x: x.day).to_frame().\

rename(columns = {colname:'day_{}'.format(colname)})

dayofweek = datetime_series.apply(lambda x: x.dayofweek).to_frame().\

rename(columns = {colname:'dayofweek_{}'.format(colname)})

return year.join(month).join(day).join(dayofweek).astype(int)

df = df.join(extract_year_month_date(df['date_received'], is_string=True, dateformat="%d/%M/%Y"))

df = df.join(extract_year_month_date(df['date_sent_to_company'], is_string=True, dateformat="%d/%M/%Y"))

# Look at the total complaints for different products, by year

pd.crosstab(df['product'], df.year_date_received)

| year_date_received | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|

| product | |||||||

| Bank account or service | 0 | 12212 | 13388 | 14662 | 17140 | 21849 | 6956 |

| Checking or savings account | 0 | 0 | 0 | 0 | 0 | 0 | 9947 |

| Consumer Loan | 0 | 1986 | 3117 | 5457 | 7888 | 9602 | 3558 |

| Credit card | 1260 | 15353 | 13105 | 13974 | 17300 | 21066 | 7132 |

| Credit card or prepaid card | 0 | 0 | 0 | 0 | 0 | 0 | 11921 |

| Credit reporting | 0 | 1873 | 14380 | 29239 | 34273 | 44081 | 16578 |

| Credit reporting, credit repair services, or other personal consumer reports | 0 | 0 | 0 | 0 | 0 | 0 | 59186 |

| Debt collection | 0 | 0 | 11069 | 39148 | 39757 | 40492 | 41101 |

| Money transfer, virtual currency, or money service | 0 | 0 | 0 | 0 | 0 | 0 | 2213 |

| Money transfers | 0 | 0 | 559 | 1169 | 1619 | 1567 | 440 |

| Mortgage | 1276 | 38109 | 49401 | 42962 | 42353 | 41471 | 26622 |

| Other financial service | 0 | 0 | 0 | 116 | 312 | 466 | 165 |

| Payday loan | 0 | 0 | 194 | 1706 | 1586 | 1567 | 493 |

| Payday loan, title loan, or personal loan | 0 | 0 | 0 | 0 | 0 | 0 | 2245 |

| Prepaid card | 0 | 0 | 0 | 336 | 1784 | 1250 | 449 |

| Student loan | 0 | 2840 | 3005 | 4283 | 4501 | 8087 | 15896 |

| Vehicle loan or lease | 0 | 0 | 0 | 0 | 0 | 0 | 2873 |

| Virtual currency | 0 | 0 | 0 | 1 | 7 | 7 | 3 |

## looking at the list of products, we can see that there's some unification which seems reasonable.

remap_products = {

# product:remapped_product

'Credit card':'Credit card or prepaid card',

'Credit reporting, credit repair services, or other personal consumer reports':'Credit reporting',

'Money transfers':'Money transfer, virtual currency, or money service',

'Virtual currency':'Money transfer, virtual currency, or money service',

'Payday loan, title loan, or personal loan':'Payday loan',

'Prepaid card':'Credit card or prepaid card',

}

df['product'] = df['product'].apply(lambda x: remap_products.get(x) if remap_products.get(x) else x)

# unify the relief responses

relief = ['Closed with monetary relief',

'Closed with non-monetary relief',

'Closed with relief']

df['relief_received'] = df.company_response_to_consumer.apply(lambda x:1 if x in relief else 0)

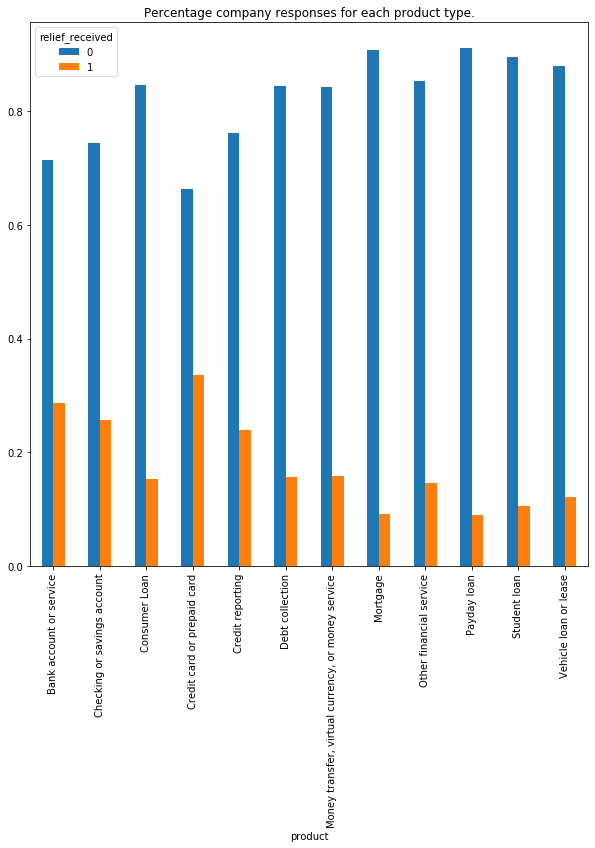

fig, ax = plt.subplots(figsize=(10,10))

tab = pd.crosstab(df['product'],df['relief_received'])

(tab.T / tab.sum(axis=1)).T.plot(kind='bar', ax=ax)

plt.title('Percentage company responses for each product type.')

# plt.tight_layout()

plt.show()

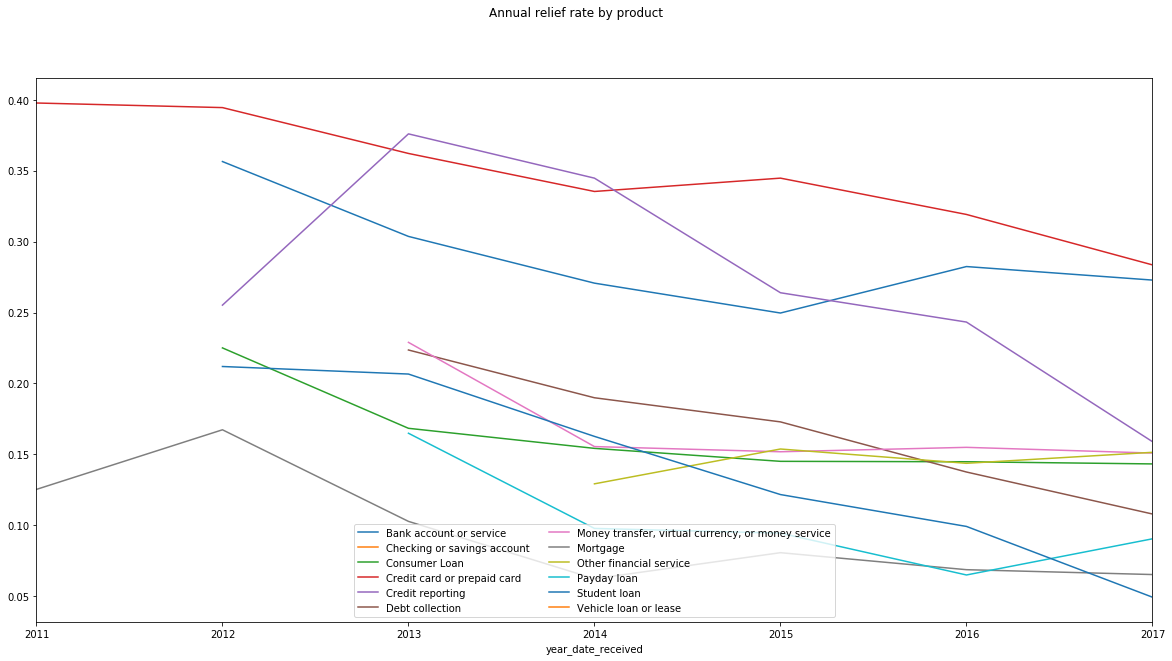

fig, ax = plt.subplots(figsize=(20,10))

df.groupby(['year_date_received','product']).relief_received.mean().unstack().plot(ax=ax)

plt.legend(loc='lower center', ncol=2)

plt.suptitle('Annual relief rate by product')

plt.show()

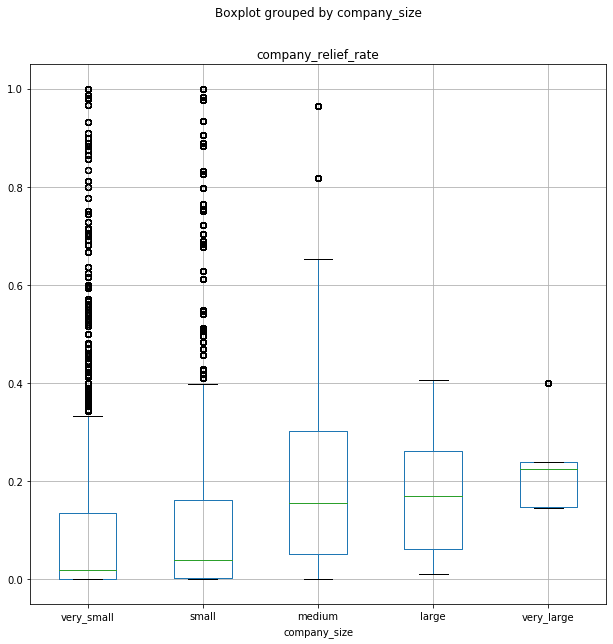

Company size

We observe that most companies have a very small number of complaints, while others have a very large number. Does this affect the relief rate?

print(\

"{0:.1f}% of companies do less than 100 transactions.".format(\

(df.groupby('company').count()['product'] < 100).sum() /\

df.company.nunique() * 100))

89.4% of companies do less than 100 transactions.

# we note that most companies are very small

company_size = df.groupby('company').count()['product']

company_size_bin = pd.cut(company_size, bins=[0, 100, 1000, 10000, 50000, 100000],

labels=['very_small', 'small', 'medium', 'large', 'very_large']).reset_index()

company_size_bin.columns = ['company', 'company_size']

df = df.merge(company_size_bin, on='company')

df['company_relief_rate'] = df.groupby('company').relief_received.transform('mean')

fig, ax = plt.subplots(figsize=(10,10))

df.boxplot(column='company_relief_rate', by='company_size',ax=ax)

plt.show()

# We can see that very large companies receive most complaints about bank accounts, credit reporting, and mortgages

pd.crosstab(df['product'], df['company_size'])

| company_size | very_small | small | medium | large | very_large |

|---|---|---|---|---|---|

| product | |||||

| Bank account or service | 1000 | 6115 | 30471 | 21322 | 27299 |

| Checking or savings account | 169 | 655 | 3625 | 2559 | 2939 |

| Consumer Loan | 2792 | 9735 | 11308 | 4441 | 3332 |

| Credit card or prepaid card | 572 | 3801 | 27592 | 58072 | 14893 |

| Credit reporting | 1942 | 5515 | 5512 | 3934 | 182707 |

| Debt collection | 36514 | 58364 | 57402 | 15051 | 4236 |

| Money transfer, virtual currency, or money service | 395 | 831 | 4960 | 635 | 764 |

| Mortgage | 7786 | 15079 | 58160 | 87537 | 73632 |

| Other financial service | 324 | 182 | 263 | 149 | 141 |

| Payday loan | 1533 | 4194 | 1647 | 216 | 201 |

| Student loan | 1640 | 4858 | 9704 | 20787 | 1623 |

| Vehicle loan or lease | 278 | 938 | 1128 | 293 | 236 |

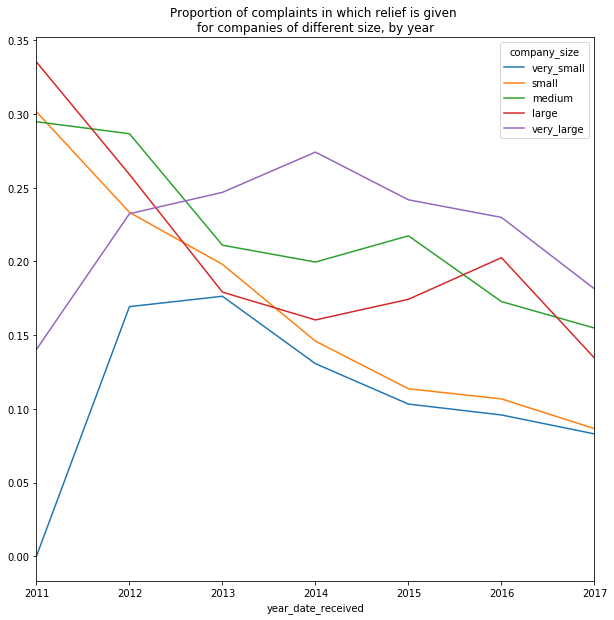

fig, ax = plt.subplots(figsize=(10,10))

df.groupby(['year_date_received','company_size']).relief_received.mean().unstack().plot(ax=ax)

plt.title('Proportion of complaints in which relief is given \nfor companies of different size, by year')

plt.show()

Discussion of exploratory data analysis

From the exploratory analysis above, we can make a few initial observations:

- Credit cards and prepaid cards, credit reporting, and account services have the highest relief rates, but these are gradually decreasing year-on-year

- Larger companies have a higher average relief rate, but there is much greater variation in small companies.

Classification

In this task, we are asked to build a classification model that can be used to:

- Determine whether a consumer’s complaint will be accepted and whether they are likely to receive relief.

- Help the CFPB understand what factors affect how a company responds to the complaints that it receives.

From this statement, we can begin to make plans about what sort of model to use in classification:

- an interpretable model will be helpful as we will immediately gain an insight into factors affecting company response

- if the model is not interpretable, we will need to use some kind of model inspection or explanation technique

- Relevant factors may be found in the text, but also in the metadata of the complaint (product, issue, tag etc.) so we should also include these features in our model.

Baseline

In any classification problem, it’s useful to establish a baseline for further development, and for nlp problems this is usually a bag-of-words input with a linear model - here we will try Logistic Regression, and a Linear SVC.

Data preprocessing

It is standard practice to undertake some cleaning of the text, such as removing stopwords and punctuation; from a brief glance at some samples, we can see that the complaints are anonymised using ‘xxxx’ tokens - these should also be removed. As mentioned above, a bag-of-words model is a standard approach, but we can also use Tf-Idf to give a relevance weighting to tokens within the text.

The following metadata features will also be included: product, issue, sub-issue, company size and tag. We will not include the actual company, as this may lead to overfitting based on the relief rate of companies in the training set, and would not generalise to new companies as they appear in the data.

There is a 4:1 imbalance in the data, which is not too extreme, but should be accounted for. As a minimum, the data must be stratified in the train-test split, and during model development we can explore the use of class weights and oversampling of the data.

df.dropna(subset=['consumer_complaint_narrative'])\

.relief_received.value_counts() / df.dropna(subset=['consumer_complaint_narrative']).shape[0]

0 0.819553

1 0.180447

Name: relief_received, dtype: float64

from sklearn.model_selection import train_test_split

from sklearn.feature_extraction.text import CountVectorizer, TfidfVectorizer

from sklearn.linear_model import LogisticRegression

from sklearn.svm import LinearSVC

from sklearn.model_selection import RandomizedSearchCV

from sklearn.metrics import classification_report

import scipy.stats as stats

np.random.seed(31415)

df_text = df.copy()

df_text.dropna(axis=0,subset=['consumer_complaint_narrative'], inplace=True)

df_text.shape

X = df_text['consumer_complaint_narrative'].str.replace('xx+','')

y = df_text.relief_received

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, stratify=y, random_state=31415)

# baseline model for logistic regression and LinearSVC

relief_tags = ['Closed with non-monetary relief',

'Closed with monetary relief','Closed with relief',]

vectorizer = CountVectorizer(strip_accents = 'unicode',

stop_words = 'english',

lowercase = True,

max_df = 0.5,

min_df = 100)

X_train = vectorizer.fit_transform(X_train)

X_test = vectorizer.transform(X_test)

models = {'lr':LogisticRegression(class_weight={0:1,1:5}, random_state=31415),

'svc':LinearSVC(class_weight={0:1,1:5}, random_state=31415)}

preds = {}

for name, model in models.items():

print(name)

model.fit(X_train, y_train)

preds[name] = model.predict(X_test)

print(classification_report(y_test, preds[name]))

lr

STOP: TOTAL NO. of ITERATIONS REACHED LIMIT.

Increase the number of iterations (max_iter) or scale the data as shown in:

https://scikit-learn.org/stable/modules/preprocessing.html.

Please also refer to the documentation for alternative solver options:

https://scikit-learn.org/stable/modules/linear_model.html#logistic-regression

extra_warning_msg=_LOGISTIC_SOLVER_CONVERGENCE_MSG)

precision recall f1-score support

0 0.91 0.66 0.77 32777

1 0.31 0.69 0.43 7217

accuracy 0.67 39994

macro avg 0.61 0.68 0.60 39994

weighted avg 0.80 0.67 0.71 39994

svc

precision recall f1-score support

0 0.89 0.74 0.81 32777

1 0.33 0.59 0.42 7217

accuracy 0.71 39994

macro avg 0.61 0.66 0.62 39994

weighted avg 0.79 0.71 0.74 39994

ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

"the number of iterations.", ConvergenceWarning)

Leveraging additional meta-data

from scipy.sparse import hstack

ohe = OneHotEncoder(handle_unknown='ignore')

# we won't use company name, as this would lead to overfitting to individual companies

features = ['product','issue','subissue','company_size']

X = df_text[['product','issue','subissue','company_size','consumer_complaint_narrative']]

X[['product','issue','subissue']] = X[['product','issue','subissue']].fillna('none')

y = df_text.relief_received

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, stratify=y, random_state=31415)

vectorizer_meta_data = CountVectorizer()

X_train_text = vectorizer_meta_data.fit_transform(X_train['consumer_complaint_narrative'])

X_test_text = vectorizer_meta_data.transform(X_test['consumer_complaint_narrative'])

X_train_features = ohe.fit_transform(X_train[features],)

X_test_features = ohe.transform(X_test[features])

X_train = hstack([X_train_text, X_train_features])

X_test = hstack([X_test_text, X_test_features])

SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: http://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

self[k1] = value[k2]

model = LogisticRegression(class_weight='balanced', random_state=31415)

model.fit(X_train, y_train)

ConvergenceWarning: lbfgs failed to converge (status=1):

STOP: TOTAL NO. of ITERATIONS REACHED LIMIT.

Increase the number of iterations (max_iter) or scale the data as shown in:

https://scikit-learn.org/stable/modules/preprocessing.html.

Please also refer to the documentation for alternative solver options:

https://scikit-learn.org/stable/modules/linear_model.html#logistic-regression

extra_warning_msg=_LOGISTIC_SOLVER_CONVERGENCE_MSG)

LogisticRegression(C=1.0, class_weight='balanced', dual=False,

fit_intercept=True, intercept_scaling=1, l1_ratio=None,

max_iter=100, multi_class='auto', n_jobs=None, penalty='l2',

random_state=31415, solver='lbfgs', tol=0.0001, verbose=0,

warm_start=False)

preds = model.predict(X_test)

print(classification_report(y_test, preds))

precision recall f1-score support

0 0.91 0.72 0.80 32777

1 0.34 0.66 0.45 7217

accuracy 0.71 39994

macro avg 0.62 0.69 0.63 39994

weighted avg 0.80 0.71 0.74 39994

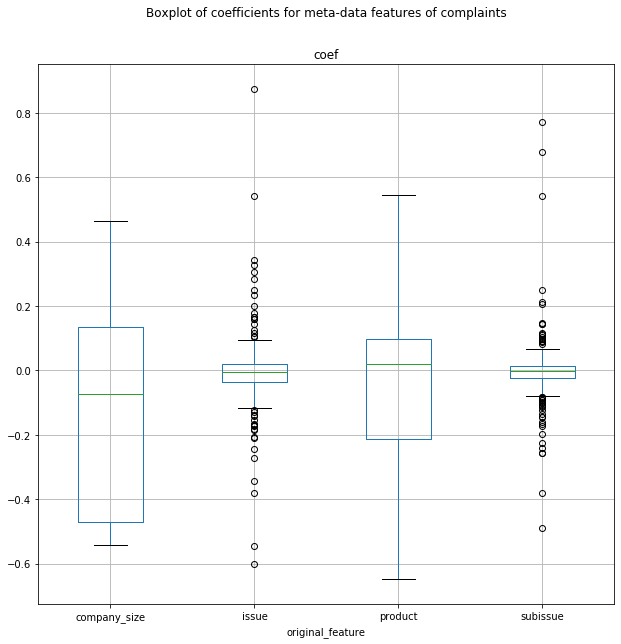

Inspecting the Logistic Regression model

feature_melt = []

for feature, categories in zip(features,ohe.categories_):

melted = [feature] * len(categories)

feature_melt += melted

categories = np.hstack(ohe.categories_)

coef_df = pd.DataFrame([categories, model.coef_[:,-len(categories):][0], feature_melt]).T

coef_df.columns = ['category', 'coef', 'original_feature']

fig, ax = plt.subplots(figsize=(10,10))

coef_df.boxplot(column='coef',

by='original_feature',

ax=ax,

)

plt.suptitle('Boxplot of coefficients for meta-data features of complaints')

plt.show()

# Display the coefficients for products

coef_df[coef_df.original_feature == 'product'].sort_values('coef', ascending=False)

| category | coef | original_feature | |

|---|---|---|---|

| 3 | Credit card or prepaid card | 0.545969 | product |

| 0 | Bank account or service | 0.326113 | product |

| 1 | Checking or savings account | 0.225128 | product |

| 5 | Debt collection | 0.0556301 | product |

| 8 | Other financial service | 0.0510896 | product |

| 2 | Consumer Loan | 0.0438741 | product |

| 11 | Vehicle loan or lease | -0.001235 | product |

| 4 | Credit reporting | -0.0166776 | product |

| 6 | Money transfer, virtual currency, or money ser... | -0.156185 | product |

| 9 | Payday loan | -0.386861 | product |

| 7 | Mortgage | -0.526208 | product |

| 10 | Student loan | -0.649351 | product |

# Display the coefficients for company size

coef_df[coef_df.original_feature == 'company_size'].sort_values('coef', ascending=False)

| category | coef | original_feature | |

|---|---|---|---|

| 381 | very_large | 0.463117 | company_size |

| 379 | medium | 0.136443 | company_size |

| 378 | large | -0.073706 | company_size |

| 382 | very_small | -0.471874 | company_size |

| 380 | small | -0.542694 | company_size |

# Display the coefficients for issues

coef_df[coef_df.original_feature == 'issue'].sort_values('coef', ascending=False)[:10]

| category | coef | original_feature | |

|---|---|---|---|

| 156 | Unable to get credit report/credit score | 0.875798 | issue |

| 134 | Problems caused by my funds being low | 0.542986 | issue |

| 87 | Late fee | 0.3429 | issue |

| 46 | Communication tactics | 0.326751 | issue |

| 159 | Unauthorized transactions/trans. issues | 0.305247 | issue |

| 80 | Improper contact or sharing of info | 0.284458 | issue |

| 101 | Managing, opening, or closing account | 0.250215 | issue |

| 108 | Other fee | 0.233449 | issue |

| 30 | Billing disputes | 0.198935 | issue |

| 56 | Credit monitoring or identity protection | 0.177035 | issue |

words = vectorizer.get_feature_names()

word_coefs = pd.DataFrame([words, models['lr'].coef_[0]]).T

word_coefs.columns = ['words','coef']

# Display the words with largest positive coefficients

print(word_coefs.sort_values('coef', ascending=False)[:60])

words coef

2844 jefferson 2.72214

1829 dynamic 2.29037

4377 rushcard 1.91164

1920 enhanced 1.57078

2789 interstate 1.4535

4376 rush 1.3884

3837 professionals 0.830137

1096 citigold 0.801865

5132 universal 0.792687

562 annualcreditreport 0.776771

3585 partners 0.68735

520 allied 0.623358

1019 cbna 0.613705

2586 hurricane 0.58328

1265 conn 0.560628

1256 conflicting 0.557217

4885 technology 0.530956

4185 repaye 0.526669

2435 guide 0.525563

1037 certification 0.522281

3318 multi 0.518445

281 809 0.499301

548 amortization 0.497155

3485 operations 0.495929

1212 completing 0.493841

715 attitude 0.491621

1016 cavalry 0.48636

4607 solely 0.483301

3075 lt 0.473938

1957 erc 0.472124

1672 diligent 0.471448

1811 driving 0.471193

2821 iq 0.467393

5048 triggered 0.464511

221 580 0.458511

5210 usury 0.456739

1024 ceased 0.452705

1165 combined 0.452562

2866 jurisdiction 0.451061

3869 proposed 0.447958

2519 hipaa 0.446082

4331 rings 0.440639

5259 vet 0.439018

4775 subsection 0.435682

4749 strict 0.434813

3480 operate 0.429676

40 1681b 0.429669

3088 macy 0.427806

3218 midland 0.424827

4313 reversing 0.423636

689 association 0.422513

5321 warned 0.421285

3027 loaded 0.420755

2895 ky 0.416796

4738 straightened 0.416616

581 apology 0.409819

2038 existent 0.409039

1630 desperate 0.408801

3907 punishment 0.4077

433 administration 0.406148

import re

def inspect_complaints(string, complaints_array, n=20):

complaints = complaints_array[complaints_array.apply(\

lambda x:True if re.search(string + '\s',x) else False)]

if n > complaints.shape[0]:

n = complaints.shape[0]

print('n was too large, printing all available complaints.\n\n')

for i in range(n):

complaint = complaints.iloc[i]

complaint = complaint.replace(string, '[[' + string + ']]')

print(complaint)

print('\n\n\n')

inspect_complaints('1681b', X.consumer_complaint_narrative)

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2014 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2015 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XX/XX/XXXX on or about XX/XX/XXXXon Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XX/XX/XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2014 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within XXXX ( XXXX ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2014 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XXXX/XXXX/XXXXon Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX XXXX XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2014 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

I just checked my personal credit report, just discovered an unauthorized and fraudulent credit inquiry made by XXXX on or about XXXX/XXXX/14 on TRANSUNION. I did not authorized anyone employed by this company or at this company or TRANSUNION to make any inquiry or inquiries and view or show my credit report to anyone, person, company, entity, business, co, corp or similar. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof Bearing my Signature or Request in Writing that I authorized them to view my credit report, then I am demanding that TRANSUNION remove the unauthorized and fraudulent hard credit inquiry immediately from my TRANSUNION credit file.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

I recently check my Transunion report and it shows an unauthorized Credit Inquiry made from XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX XXXX, UT XXXX ( XXXX ) XXXX.

While checking my personal credit report, which I acquired from [ Transunion ] noticed an inquiry made by the company on XX/XX/2017 I did not authorized anyone employed by the company to make an inquiry and view my credit report. it have violated the Fair Credit Reporting Act Section [[1681b]] ( c ) .You are not legally entitled to make the inquiry. This is a serious breach of my privacy rights.

I request that you either mail me a copy of my signed authorization form that gave you the right to view my credit within five ( 30 ) business daysso that I can verify its validity

XXXX XXXX offered me a chance to receive a secured credit card with an opening deposit twice and I was denied both times. I was n't planning on applying for anything during those times as I was repairing my credit. I applied because I was allegedly pre-approved. That 's not fair to the consumer. Neither XXXX XXXX nor the XXXX credit bureaus ( TransUnion, XXXX , and XXXX ) will ho nor removing the inquiries even though I was solicited by XXXX XXXX . The FACTS states inquiries can only be pulled under certain conditions and " firm '' offers a re one of those conditions. Here is a reference to the code under ( c ) ( 1 ) ( B ) ( I ) : 15 U.S. Code [[1681b]] - Permissible purposes of consumer reports ( c ) Furnishing reports in connection with credit or insurance transactions that are not initiated by consumer ( 1 ) In general A consumer reporting agency may furnish a consumer report relating to any consumer pursuant to subparagraph ( A ) or ( C ) of subsection ( a ) ( 3 ) in connection with any credit or insurance transaction that is not initiated by the consumer only if ( A ) the consumer authorizes the agency to provide such report to such person ; or ( B ) ( i ) the transaction consists of a firm offer of credit or insurance ; ( ii ) the consumer reporting agency has complied with subsection ( e ) ; ( iii ) there is not in effect an election by the consumer, made in accor dance with subsection ( e ), to have the consumers name and address excluded from lists of names provided by the agency pursuant to this paragraph ; and ( iv ) the consumer report does not contain a date of birth that shows that the consumer has not attained the age of 21, or, if the date of birth on the consumer report shows that the consumer has not attained the age of 21, suc h consumer consents to the consumer reporting agency to such furnishing.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

Please check the attached FTC ID Theft report, there are several inquiries on my credit report, they are all listed accordingly on that report. I did not give your company permission to run my credit nor do you have any permissible purpose to run my credit. Since it is against the FCR A, 604. Permissible purposes of consumer reports [ 15 U.S.C. [[1681b]] ] for an entity to view a consumers credit report without a permissible purpose. I am writing to inquire as to your alleged purpose for doing so since I did not apply for any credit with your company. This inquiry was performed under false pretenses as described in the clear language of the la w. 15 USC 1681n ( a ) ( 1 ) ( B ) wh ich states, in part, in the case of liability of a natural person for obtaining a consumer report under false pretenses or knowingly without a permissible purpose, actual damages sustained by the consumer as a result of the failure or {$1000.00}, whichever is greater ;

While checking my personal credit report, I discovered an Unauthorized and Fraudulent credit inquiry made without my KNOWLEDGE or CONSENT by XXXX on or about XXXX/XXXX/2014 on TRANSUNION credit file. I did not authorized or give permission to anyone employed by this company to make any inquiry and view my credit report. XXXX XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights. I am requesting that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus and have them remove the unauthorized and fraudulent hard inquiry immediately.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX onTransunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report.XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XX/XX/XXXX in case it is needed to locate the fraudulent inquiry in their system.

While checking my personal credit report, I noticed an unauthorized and fraudulent credit inquiry made by XXXX on or about XX/XX/XXXX on Transunion. I did not authorized anyone employed by this company to make any inquiry and view my credit report. XXXX has violated the Fair Credit Reporting Act Section [[1681b]] ( c ). They were not legally entitled to make this fraudulent inquiry. This is a serious breach of my privacy rights.

I have requested that they mail me a copy of my signed authorization form that gave them the right to view my credit within five ( 5 ) business days so that I can verify its validity and advised them that if they can not provide me with proof that I authorized them to view my credit report then I am demanding that they contact the credit bureaus immediately and have them remove the unauthorized and fraudulent hard inquiry immediately. I also requested that they remove my personal information from their records. My Social Security # is XXXX and my Date of Birth is XXXX in case it is needed to locate the fraudulent inquiry in their system.

Conclusions

- The Logistic Regression model with metadata features confirms our observations that the products most indicative of receiving relief are credit cards and prepaid cards, bank and checking accounts.

- The model confirms that larger companies are more likely to award relief.

- Inspection of complaints text using the model coefficients, reveals some specific issues:

- The Dodds-Frank law, codes 1681b and 1681g from the US consumer laws

- Length of complaint may be indicative of likelihood of relief (examples)

- Company names are often embedded in complaints, so there is a possibility of overfitting to individual companies

Appendices

Parameter Optimisation Code to optimise the logistic regression model using a randomised search.

Thresholding predictions The CFPB can control the level of recall and precision in the model predictions by applying a threshold against the prediction probabilities. In this way, they can understand the trade-off between the reduction in number of complaints they want to achieve using the model, and the proportion of potentially successful complaints they might miss by doing so.

Latent Dirichlet Allocation Topic modelling is a helpful way to explore text data, and is an unsupervised method. pyLDAvis is used to visualise the output of an LDA model.

Parameter optimisation to get a strong model

from sklearn.compose import ColumnTransformer

from sklearn.pipeline import Pipeline

from sklearn.preprocessing import StandardScaler, FunctionTransformer

from sklearn.feature_extraction.text import TfidfTransformer

def xx_remove(X):

## function to remove the xx blanks in strings, as this is noise

fixed = X.str.replace('xx+','')

return fixed

categorical_features = ['product', 'issue', 'sub-issue', 'company_size']

text_features = 'consumer_complaint_narrative'

categorical_transformer = Pipeline(steps=[

('ohe', OneHotEncoder(handle_unknown='ignore')),

('scaler', StandardScaler(with_mean=False))

])

text_transformer = Pipeline([

('xx', FunctionTransformer(xx_remove)),

('vect', CountVectorizer(strip_accents = 'unicode',

stop_words = 'english',

lowercase = True)),

('tfidf', TfidfTransformer())

])

preprocessor = ColumnTransformer(

transformers=[

('cat', categorical_transformer, categorical_features),

('text', text_transformer, text_features)

])

clf = Pipeline(steps=[

('preprocessor', preprocessor),

('classifier', LogisticRegression())

])

parameters = {

'preprocessor__text__vect__max_df': (0.5, 0.75, 1.0),

'preprocessor__text__vect__max_features': (None, 5000, 10000, 50000),

'preprocessor__text__vect__ngram_range': ((1, 1), (1, 2)), # unigrams or bigrams

'preprocessor__text__tfidf__use_idf': (True, False),

'preprocessor__text__tfidf__norm': ('l1', 'l2'),

'preprocessor__cat__scaler':['passthrough', StandardScaler(with_mean=False)],

'classifier__C':stats.uniform(0.1,10),

'classifier__class_weight':[{1:w,0:1} for w in range(2,10)]

}

random_search = RandomizedSearchCV(clf, parameters, cv=3, n_iter=10, random_state=31415)

random_search.fit(X_train, y_train, scoring=['f1_score','recall','precision'])

preds = random_search.predict(X_test)

print(classification_report(y_test, preds))

precision recall f1-score support

0 0.88 0.82 0.85 10647

1 0.45 0.57 0.51 2715

accuracy 0.77 13362

macro avg 0.67 0.70 0.68 13362

weighted avg 0.80 0.77 0.78 13362

Oversampling

from imblearn.over_sampling import SMOTE

smote = SMOTE(n_jobs=4)

X_train_smote, y_train_smote = smote.fit_sample(preprocessing.fit_transform(X_train), y_train)

model = LogisticRegression(max_iter=200)

model.fit(X_train_smote, y_train_smote)

preds = model.predict(preprocessing.transform(X_test))

print(classification_report(y_test, preds))

Prediction threshold

preds = randomised_search.predict_proba(X_test)

for i in np.arange(0.3, 1, 0.1):

print(i,'\n',classification_report(y_test, preds[:,1] > i))

LDA

vect = CountVectorizer(strip_accents = 'unicode',

stop_words = 'english',

lowercase = True,

max_df = 0.5,

min_df = 100)

raw_text = df.dropna(subset=['consumer_complaint_narrative'])

raw_text.consumer_complaint_narrative = raw_text.consumer_complaint_narrative.apply(lambda x:x.lower())

lda = LatentDirichletAllocation(n_components=5) # one component for each product

encoded = vect.fit_transform(raw_text.consumer_complaint_narrative[raw_text.relief_received == 1].sample(10000))

lda.fit(encoded)

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: http://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

self[name] = value

from pyLDAvis.sklearn import prepare

import pyLDAvis

vis = prepare(lda, encoded, vect,

# mds='tsne'

)

pyLDAvis.enable_notebook()

pyLDAvis.display(vis)

topics = lda.transform(encoded)

text_with_topics = raw_text[raw_text.relief_received == 1]

text_with_topics['top_topic'] = topics.argmax(axis=1)

text_with_topics['top_topic_prob'] = topics.max(axis=1)

text_with_topics.top_topic.value_counts()

pd.crosstab(text_with_topics['issue'], text_with_topics.top_topic).sort_values(by=0, ascending=False)

n_samples = 2000

n_features = 1000

n_components = 10

n_top_words = 20

def print_top_words(model, feature_names, n_top_words):

for topic_idx, topic in enumerate(model.components_):

message = "Topic #%d: " % topic_idx

message += " ".join([feature_names[i]

for i in topic.argsort()[:-n_top_words - 1:-1]])

print(message)

print()

print_top_words(lda, vect.get_feature_names(), n_top_words)